Basquiat Market Prediction for Collectors in 2026–2028

Jean-Michel Basquiat remains a bellwether for the contemporary market: when confidence returns, his best works are among the first to be chased; when sentiment cools, his market tends to sort itself into clear quality tiers rather than collapsing across the board. That “tiering” is exactly why a price-band approach is useful right now. The broader auction market has been uneven since 2023, with softness at the extreme top end and pressure in the lower-value segments, even as select mid-range categories show signs of stabilization. Mid-year 2025 analysis, for example, showed the $100,000–$1 million bracket contracting while the $1 million–$10 million bracket grew, and the $10 million+ segment fell sharply in the first half of 2025. This environment generally rewards the most recognizable artists with the clearest demand signals—Basquiat chief among them.

At the same time, auction houses themselves have pointed to a modest recovery in 2025, paired with a measurable shift toward younger buyers participating in the market. Basquiat’s cultural position—canonized in museums, deeply embedded in popular culture, and central to conversations about identity, power, and American history—aligns strongly with those demographic currents. This is one reason why, even when the market is selective, Basquiat demand often remains decisive for the right material.

What follows is a collector-focused forecast across four practical tiers—$40k+, $80k, $100k, and $150k+—with an emphasis on growth prospects and downside resilience. It is not financial advice, but a framework for how sophisticated buyers are likely to think about Basquiat exposure over the next 24–36 months.

The Core 2026 Thesis: “Selective strength, not blanket heat”

The Basquiat market continues to be led by trophy paintings and exceptional works on paper, which act like headline assets. In May 2025, Christie’s sold Basquiat’s Baby Boom for $23.4 million, reinforcing that high-quality works remain liquid even when the market is cautious. At the very top end, major Basquiats still function as global currency: they draw bidders across regions and often become the defining lots of a season.

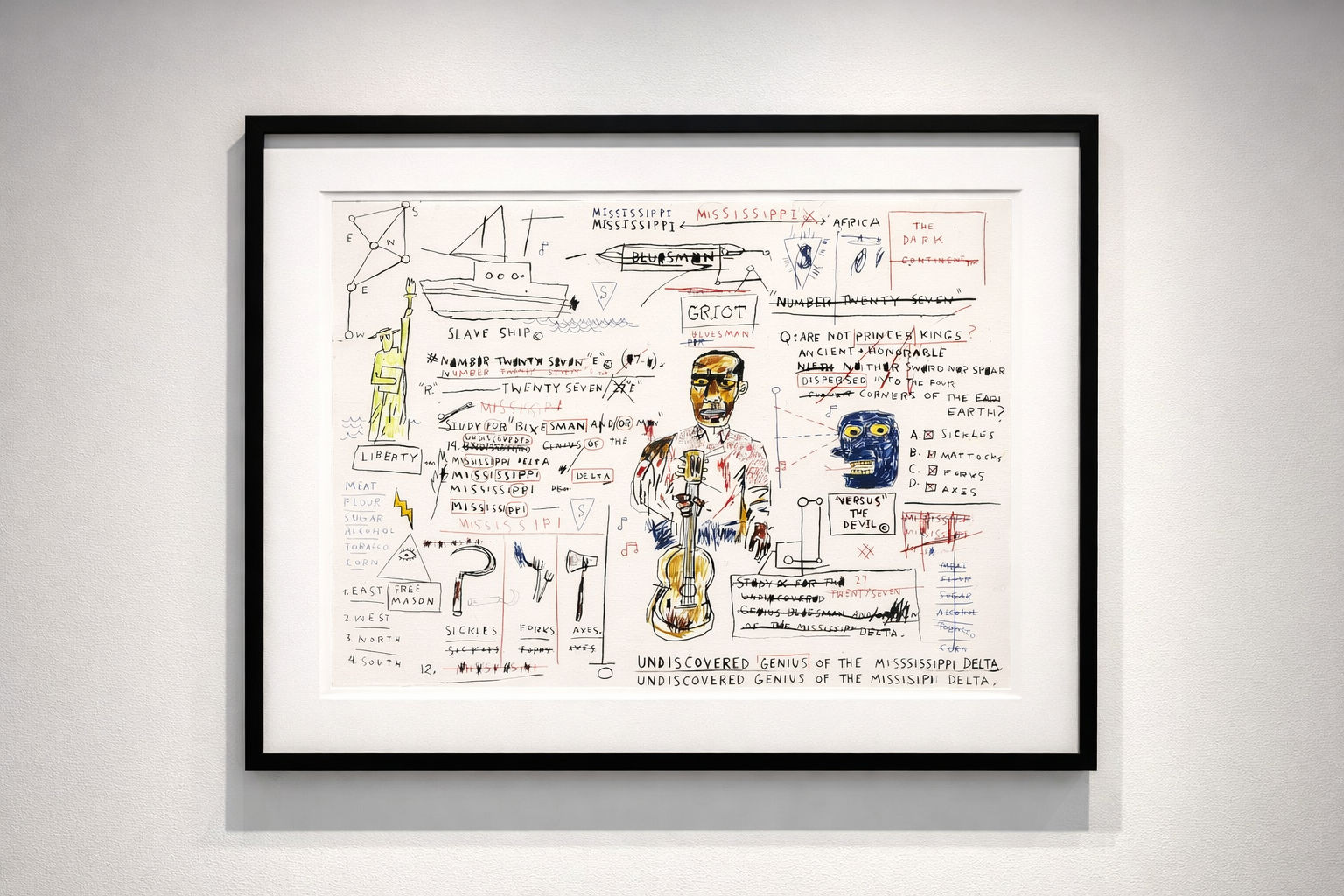

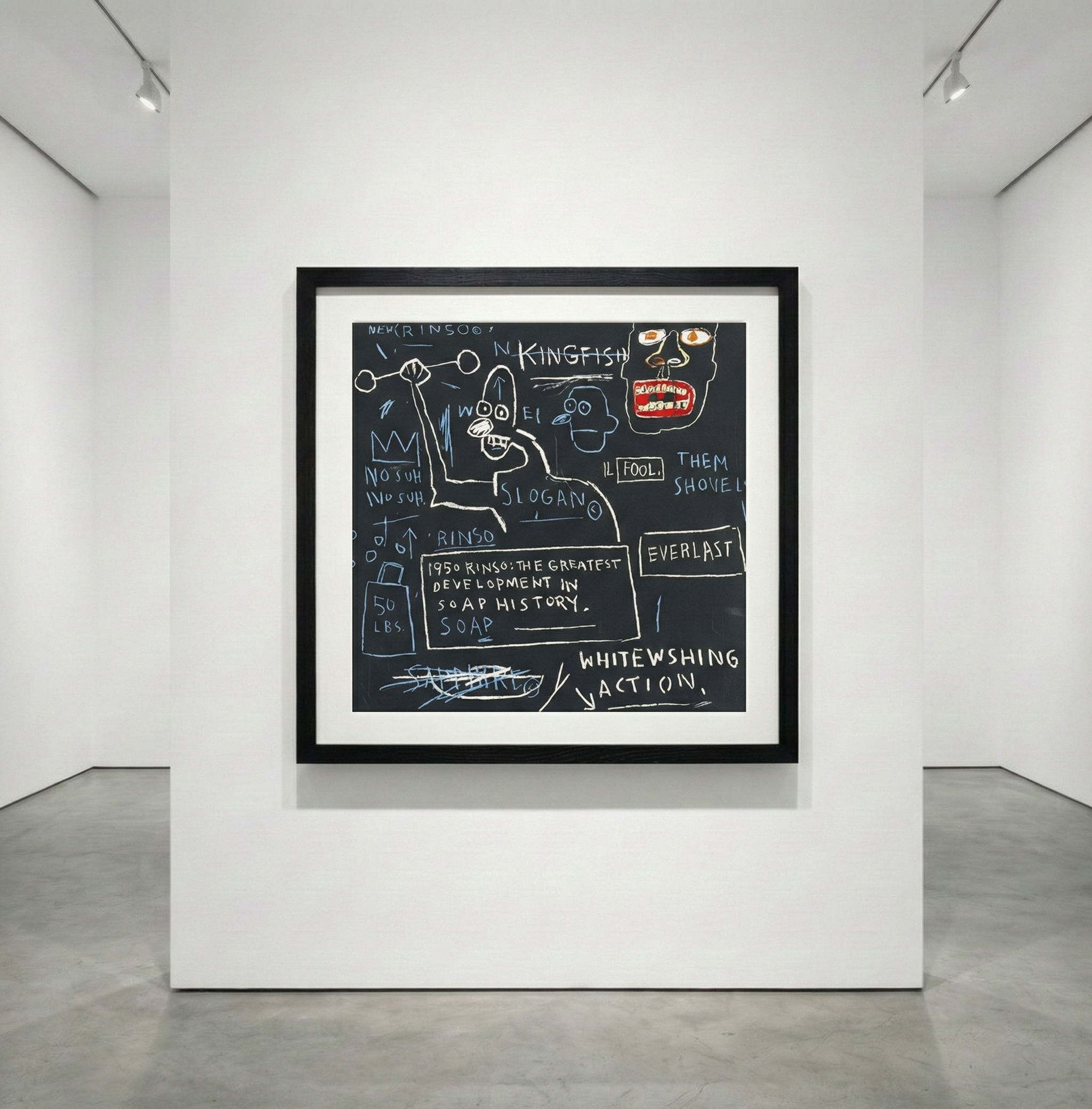

But the real story for most collectors sits below that trophy layer: prints and works on paper, where the market is broader, more active, and more sensitive to condition, edition details, and “image power.” Even here, the overall market climate matters. data showing contraction in the $100,000–$1 million auction bracket in the first half of 2025 suggests that buyers are choosier in exactly the price range where many Basquiat prints and works on paper trade. That does not imply weakness for Basquiat so much as a sharper premium for quality and freshness-to-market.

So the best prediction for 2026–2028 is not “Basquiat goes up across the board.” It is that Basquiat continues to outperform the average contemporary segment through selective demand—meaning iconic images, tight editions, clean condition, and strong provenance should see healthier appreciation and easier liquidity than secondary motifs or compromised examples.

$40,000+ Basquiat: the “entry blue-chip” lane (high liquidity, lower volatility)

This band tends to capture widely traded editions and estate-related print material that sits at the gateway between passionate collecting and serious asset allocation. In practice, this tier is often where newer Basquiat collectors enter, and where experienced collectors add breadth without tying up excessive capital.

A key signal here is that “base level” Basquiat edition pricing has already migrated upward compared with earlier cycles, and is increasingly described by market participants as a $35,000–$50,000 zone for certain estate prints (often depending on image, size, and condition). When a market’s entry point rises and holds, it can indicate that demand is not purely speculative; it is being supported by sustained cultural interest, gift/legacy collecting, and a steady stream of first-time buyers.

2026–2028 prediction for $40k+ works: expect modest, steadier growth rather than dramatic spikes. In a “normalized” market environment, collectors should think in terms of low-to-mid single-digit annual appreciation for average examples, with higher performance reserved for the most iconic images in top condition and with strong documentation. Liquidity should remain strong because this band matches the buying power of a wide collector base, including younger buyers now more present in the auction ecosystem.

Stability drivers in this tier:

Basquiat’s cross-generational recognition, the portability and display friendliness of prints, and the fact that many buyers treat these works as “core holdings” rather than flip assets. The biggest risk is not demand evaporating; it is buying the wrong example—faded, heavily handled, poorly framed, or with unclear edition specifics—then discovering that your work is less liquid than you assumed.

In other words: in the $40k+ band, the market is more forgiving than at higher levels, but condition and authenticity paperwork still do the heavy lifting.

$80,000 Basquiat: The “Image Premium” :ane (Demand concentrates around the strongest motifs)

Around $80,000 is where Basquiat edition buying often becomes more strategic. Buyers are no longer simply “getting a Basquiat.” They are trying to secure an image with real market gravity—something that reads instantly as Basquiat, not just adjacent to his visual language.

This is typically where you see a meaningful divergence between A-images and B-images. The A-images trade quickly, appear repeatedly in curated contexts, and often have tighter edition sizes, stronger publication histories, or more compelling references to Basquiat’s key themes. The B-images may still sell, but they do so with more sensitivity to timing and the broader market.

2026–2028 prediction for $80k works: this band should be stable with a bias to growth, but the growth will be uneven. Iconic, clean examples are likely to appreciate at a healthier clip than the “average” $40k+ tier, because collectors in this band are more likely to upgrade rather than churn. Expect mid single-digit annual growth as a baseline for strong material, with the potential for sharper increases when supply is thin and an example is fresh to market.

Stability drivers:

A widening international buyer base for blue-chip editions, and the continued institutional reinforcement of Basquiat’s importance. You are also insulated somewhat by substitution effects: when paintings and elite drawings become unattainable, collectors reallocate into the strongest edition material.

$100,000 Basquiat: The “Quality Filter” Lane (More upside, but only for the best examples)

The $100,000 tier sits at a psychologically important threshold. Above six figures, buyers behave differently: due diligence becomes more formal, condition reports matter more, and collectors tend to compare opportunities across artists rather than buying impulsively.

This is also the exact range where macro market softness can show up. Mid-year 2025 data flagged a decline in the $100,000–$1 million range at auction, which suggests that buyers in this bracket are being more selective overall. For Basquiat, that selectivity tends to translate into sharper price dispersion: the very best examples sell well, while weaker examples can stall or require pricing realism.

2026–2028 prediction for $100k works: this band is likely to deliver the most interesting risk-adjusted returns for Basquiat edition collectors who buy “best-in-class.” The growth outlook is positive, but conditional: strong works could reasonably outperform broader prints-and-multiples segments, while marginal works may remain flat.

What does “best-in-class” look like here? It usually means some combination of recognized imagery, low supply, strong condition, clean provenance, and market visibility (the kind of work that appears in serious private collections and reputable sales contexts). If you are buying into six figures, the prediction is that the market will increasingly reward those qualities—and penalize anything that introduces doubt.

Stability drivers:

Basquiat’s continued function as a benchmark artist, plus the ongoing trend of collectors “buying quality, not quantity” in uncertain markets. That aligns neatly with how Basquiat supply works: truly top material is not abundant, and when it appears, it tends to attract competition.

$150,000+ Basquiat: The “Rarity and Trophy Print / Premium works-on-paper” Lane (Highest upside, highest scrutiny)

Once you cross $150,000, you are typically dealing with either very strong editions (often rare, tightly held, or exceptionally desirable) or more serious works on paper. This tier is where scarcity becomes an active pricing force and where collectors start to speak in terms of “owning something that could anchor the room,” not just “owning a Basquiat.”

A useful example of how this tier behaves is the market’s response to high-profile Basquiat prints with meaningful demand. Certain Basquiat print results have reached well into the hundreds of thousands; for instance, in February 2024 the Phillips London result for Back of the Neck with a buyer-paid figure of $310,000 (with hammer and other figures also noted). Whether a particular sale is representative depends on edition details and the individual work, but it illustrates the core point: above $150,000, Basquiat prints can begin to resemble trophy assets with real auction theater.

At the same time, this is a band where the market becomes less forgiving about anything “off.” The wrong matting history, unclear signature status, fading, cockling, restoration, or missing documentation can take a meaningful bite out of liquidity. Buyers spending $150,000+ have alternatives, and they will exercise them.

2026–2028 prediction for $150k+ works: this tier is likely to show the strongest upside when the right examples appear, because scarcity and competition can compress quickly. Over the next 24–36 months, the most likely scenario is not a uniform rise, but periodic “step-ups”—moments where a standout work resets a benchmark for its type, then the market reprices similar examples.

However, you should also expect more volatility in outcomes from sale to sale, because the buyer pool is smaller and expectations are higher. When the work is perfect, bidding can be decisive. When there is uncertainty, pricing can soften abruptly.

Stability drivers:

Basquiat’s continuing trophy status. Even when the wider market debates direction, the best Basquiats remain globally legible and culturally urgent. High-end Basquiat sales—like Christie’s Baby Boom in 2025—help maintain that perception of Basquiat as a “first-rank” name, which tends to buoy confidence across adjacent categories, including premium works on paper and rare editions.

What Could Derail The Forecast? Three realistic risks

The biggest risks to Basquiat market stability in these price bands are not about Basquiat losing relevance; they are about market mechanics and buyer psychology.

First, macro uncertainty can temporarily reduce bidding appetite in the $100k+ segment, as seen in broader auction-bracket contraction for $100k–$1m in early 2025. When that happens, collectors still buy Basquiat, but they buy with sharper preferences. That can create a “two-speed” market, where the best examples rise and the rest stagnate.

Second, supply timing matters. If too many similar prints hit the market at once, prices can soften short-term even if the long-term trend is healthy. The reverse is also true: scarcity can create sudden jumps.

Third, condition and documentation become increasingly decisive as you move higher. Many of the best print opportunities are won not by the person most excited, but by the person who is most disciplined about selecting the right example.

Bottom line: Where Growth and Stability Look Strongest

If your goal is stability with reasonable growth, the $40,000–$100,000 lane is likely to remain the market’s “liquid core.” Demand is broad, cultural relevance is durable, and the buyer base is growing more international and younger.

If your goal is stronger growth potential with higher scrutiny, the $150,000+ lane is where scarcity and competition can generate step-change pricing—provided you buy top examples and accept that outcomes can be more variable from sale to sale.

Across all tiers, the most credible prediction is that Basquiat continues to behave like a blue-chip “quality sorting machine.” In a selective market, he does not so much cool off as concentrate. The winners will be the works that are instantly recognizable, demonstrably scarce, and unimpeachably clean. The stability comes from the fact that Basquiat is not just a market story; he is an art-historical cornerstone—and the market tends to protect cornerstone artists even when it questions everything else.

Discover Basquiat prints for sale and contact our galleries for latest availabilities. Looking to sell? We can help. Find out how to sell Basquiat art with our expert teams.