Alex Katz’s remarkable performance at Art Basel Miami Beach 2025 has solidified his position as one of the most relevant and financially resilient contemporary artists of the moment. While many markets have experienced volatility, correction, or collector hesitation, Katz’s market stood out for its strength, clarity, and confidence. Two major works, Orange Hat 2 from 1973 and Wildflowers 1 from 2010, sold for 2.5 million USD and 1.5 million USD respectively, placing Katz in the top tier of blue-chip painters at the fair. These transactions were not simply impressive sales figures; they were a clear signal of an artist whose long-term market foundations remain exceptionally strong. For collectors, this moment represents a unique opportunity: Katz is both historically validated and currently in high demand. Combined with the increasing scarcity of strong examples entering private circulation, there has never been a more compelling time to consider acquiring an Alex Katz work, especially through a gallery with direct expertise such as Guy Hepner.

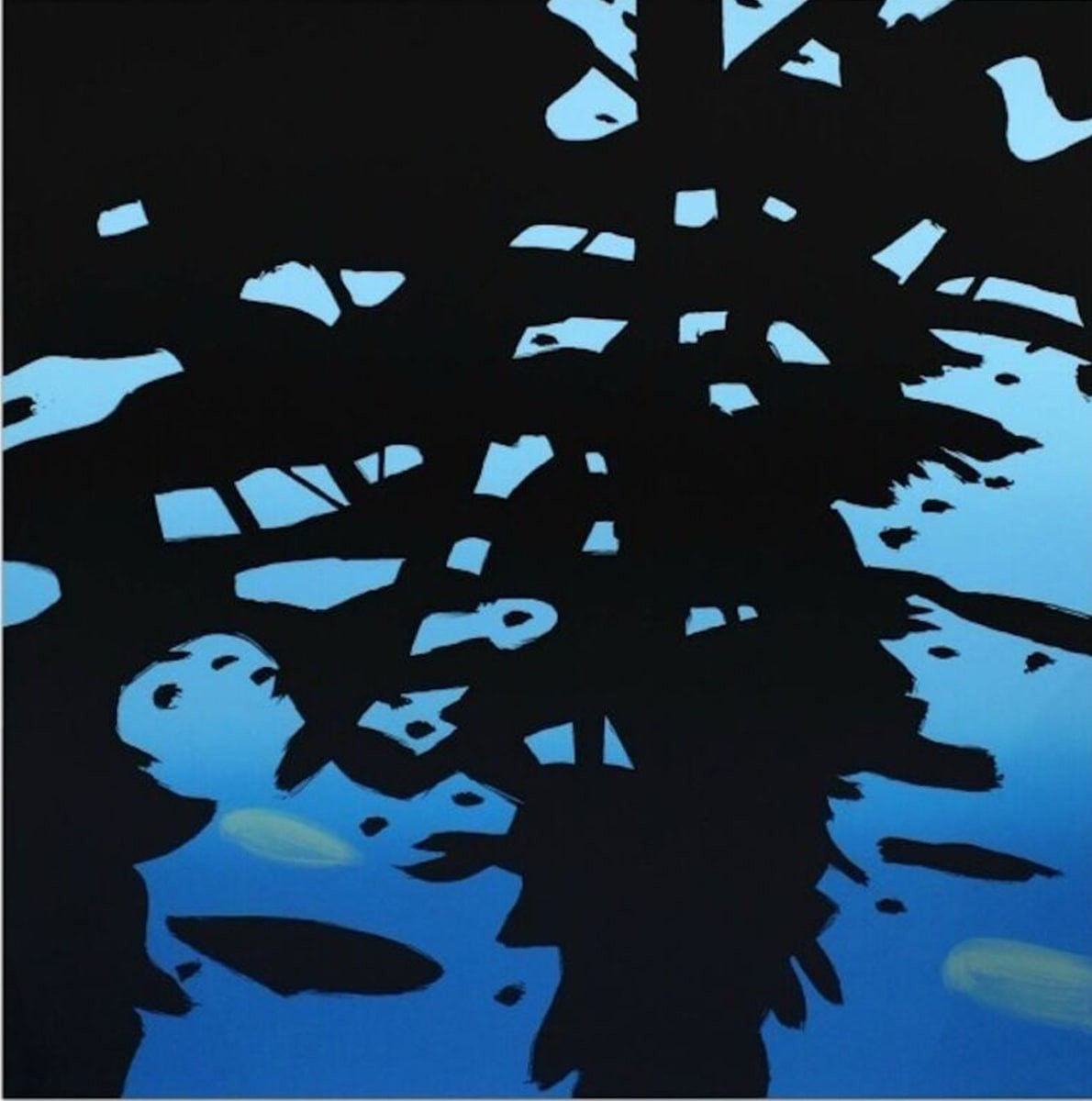

Katz’s market strength is rooted in the timelessness and adaptability of his aesthetic. Since the mid-20th century, he has pushed a distinct visual language defined by flat planes of color, severe cropping influenced by film and advertising, and an emotional coolness that gives his figures — especially his iconic portraits of Ada — their unmistakable presence. Far from feeling dated, Katz’s style reads today as incredibly contemporary. In a world saturated with digital visuals, slick commercial imagery, and the aesthetics of social media, Katz’s restraint, clarity, and bold simplicity feel deeply aligned with the visual culture of the present. His paintings look as though they could have been created yesterday, and this is precisely why younger collectors and seasoned buyers alike continue to gravitate toward his work.

The Art Basel Miami Beach results demonstrated this clearly. Orange Hat 2, a deeply recognizable Ada portrait defined by its bright orange hat, stark cropping, and serene facial expression, ranks as one of the strongest figurative canvases sold at the fair. It represents the essence of Katz’s portraiture: cinematic, elegant, and effortlessly modern. The fact that a 1973 painting commanded 2.5 million USD at the fair shows that early Katz paintings remain extremely coveted, particularly those that capture Ada in her most iconic presentations. Meanwhile, Wildflowers 1 at 1.5 million USD illustrated that collectors are equally willing to invest in his more recent works. The healthy demand for both early and later paintings suggests a market not dependent on one period or motif, but balanced across decades — a sign of a mature, stable, and reliable market.

Beyond auction results and fair sales, Katz’s current relevance is reinforced by sustained institutional support. His major retrospective at the Guggenheim, Alex Katz: Gathering, which spanned from 2022 into early 2023, brought renewed attention to the full sweep of his career. The exhibition highlighted how consistent and uncompromising his vision has been over the decades, and how far ahead of his time Katz truly was. Additional museum presentations in Europe and the United States have continued to position Katz at the forefront of contemporary painting conversations. Museums strengthen markets, and museums have been actively spotlighting Katz. For collectors, this kind of institutional reinforcement translates into long-term value and long-term demand.

Another factor contributing to Katz’s investment appeal is the unique position he occupies as a living artist with an oeuvre that already reads like a complete chapter of art history. At 98, Katz is still painting, still refining his subjects, and still pushing his compositions. Unlike many of his blue-chip contemporaries whose works are now managed by estates, Katz’s market benefits from an active studio, consistent production, and a steady release of new works that refresh collector interest. At the same time, the supply of iconic early paintings — especially Ada portraits and classic 1970s canvases — is increasingly limited, as more examples enter long-term private collections or institutions. This combination of ongoing creativity paired with growing scarcity of landmark works is exactly the dynamic that supports rising valuations.

Katz’s print market further highlights the depth of his collector base. His screenprints and editioned works have gained strong traction, with many selling in the high five-figure to six-figure range. These prints are not an afterthought of his practice; they are integral to how Katz has built his visual language and expanded his audience. Prints offer collectors an entry point into Katz’s world while still delivering strong investment value over time. When major paintings achieve multi-million-dollar results, prints often appreciate in tandem. This creates a layered market in which collectors can engage across price points, building a collection that can grow and appreciate over time.

Given this landscape, acquiring an Alex Katz work now represents a strategic decision. His market has proven resistant to downturns, it is supported by institutional validation, it is continually refreshed by new bodies of work, and it holds cross-generational appeal. Yet, navigating the Katz market — particularly when seeking the strongest examples — requires access, expertise, and an understanding of how different periods, sizes, compositions, and subjects perform. This is where acquiring through Guy Hepner offers distinct advantages.

Guy Hepner has extensive experience placing Katz works, sourcing both early and recent paintings from trusted private collectors and dealers with strong provenance. The gallery understands the nuances that separate a good Katz from an exceptional one — differences in edition numbers, rare motifs, condition, printing variations, and the unique market position of portraits versus landscapes versus florals. In a competitive market where top-tier Katz paintings often sell privately before they ever appear publicly, the ability to access a curated selection through an established gallery becomes essential. Additionally, the gallery guides collectors through valuation, authenticity, framing, long-term care, and market timing, ensuring that acquisitions are not only aesthetically meaningful but strategically sound.

Art Basel Miami Beach 2025 has made something undeniably clear: Katz is not simply experiencing a late-career resurgence. His market is strong, consistent, and deeply supported, making him a remarkably safe and compelling investment within contemporary art. As top works continue to be absorbed into permanent collections and scarcity increases, the opportunity to acquire significant Katz pieces becomes even more valuable. Collectors who act now position themselves at the center of one of the most stable and ascending markets of 2025.