Jean-Michel Basquiat occupies a rare position in the market: he is at once a symbol of 1980s New York and a fully global blue-chip brand. For collectors today, he offers something few contemporary names can match – historically anchored importance, deep institutional validation, and a market that has already passed through several cycles of boom, correction, and consolidation. Understanding where his market sits in 2025, and how to navigate it intelligently into 2026, is essential for anyone considering a meaningful Basquiat acquisition.

Where the Basquiat Market Stands in 2025

On the headline level, Basquiat remains one of the most valuable artists of the post-war period. His auction record, the 1982 skull painting Untitled that sold for $110.5 million at Sotheby’s in 2017, still anchors his reputation and confirms him as one of the very few artists whose work trades comfortably above the $100 million threshold.

Since that landmark sale, his market has broadened and matured. Auction data shows that annual sales for Basquiat reached a high of roughly $439.6 million in 2021 before falling by about 50% in 2022 – a correction that mirrored the wider cooling of the ultra-contemporary segment. Yet even in this “downturn,” key works continued to achieve major prices: El Gran Espectáculo (The Nile) realized $67.1 million in 2023, and Self-Portrait as a Heel (Part Two) brought $42 million.

In 2024 and 2025, the picture is one of selective but decisive demand. In May 2024, Phillips sold Untitled (ELMAR) for $46.5 million – the top estimated lot of the week – demonstrating that top-tier Basquiat still commands competition even in a softer macro art market. At the works-on-paper level, a Basquiat drawing led Christie’s 21st-century sale in November 2024 at around $23 million, underlining how far the best works on paper have climbed, in some cases approaching lower-tier canvases.

In short: the speculative froth has eased, but the hierarchy of quality is clearer than ever. Prime 1981–83 paintings, historically key works on paper, and strong provenance examples remain aggressively competed for. Lesser works, late pieces, or compromised examples have adjusted downwards – which, for informed collectors, can actually create opportunities.

The Print and Edition Market: Volatility and Opportunity

Basquiat’s print market has travelled a more volatile path than his paintings, but the longer-term trend remains convincingly upward. Analysis of prints and multiples from 2010 to 2024 indicates compound annual growth of roughly 10–15%, outpacing many financial assets and confirming the status of his editions as a serious collecting category rather than a peripheral one.

There have, however, been sharp short-term swings. Turnover in the Basquiat print market peaked at around £2.68 million in 2022, before falling to roughly £233,000 in 2024 – a dramatic 85% year-on-year drop, reflecting both a thinner supply of top prints and a broader reset in risk appetite. Yet 2025 has already seen a rebound in confidence, with portfolios such as the Daros Suite, Superhero Portfolio achieving strong results and, in some cases, new records at Sotheby’s and Phillips.

Individual images, like the Flexible screenprint and the Hollywood Africans print, illustrate the longer arc. Flexible – based on the 1984 painting of a griot figure – has shown dramatic value growth over the past decade, while Hollywood Africans has delivered returns of around +58% for some investors, according to gallery reporting.

For collectors, the message is clear: Basquiat’s editions are now an established tier of the market with their own internal blue-chip hierarchy. Signed, lifetime-related works and iconic motifs carry a meaningful premium over later, posthumous or less resonant images.

How Collectors Are Positioning Themselves

A considered Basquiat strategy in 2025–26 usually involves thinking in tiers rather than chasing a single trophy.

-

Museum-Level Paintings (and the Rarest Works on Paper)

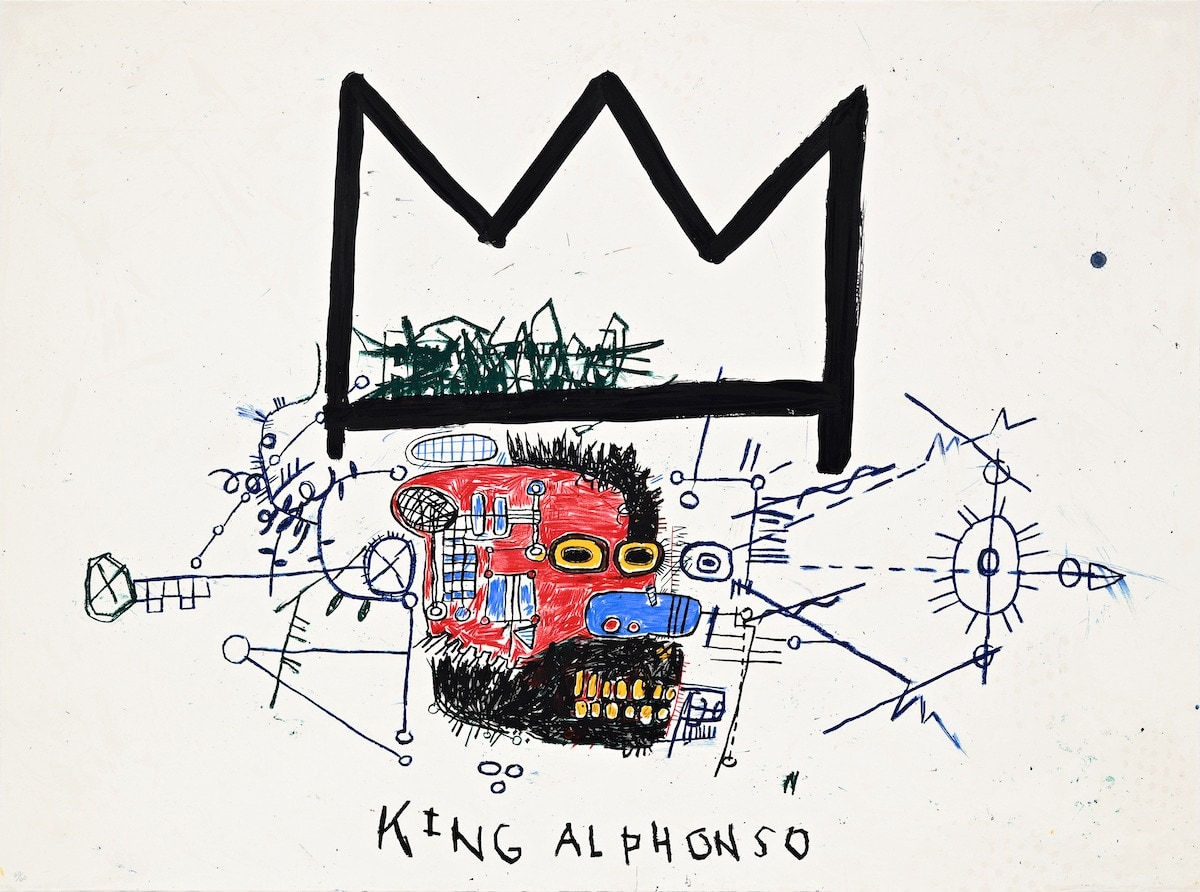

This is the realm of institutional competition: large-scale canvases from 1981–83, with archetypal motifs – skulls, crowned heads, skeletal figures, anatomical diagrams – and strong exhibition pedigrees. These works sit at the top of the market narrative and are likely to remain core assets for major collections and museums. Even in a cooler environment, the truly great examples remain scarce, tightly held, and expensive to prise out. -

Serious Works on Paper

Drawings are no longer “entry level.” The best sheets – dense in imagery, text, and iconography – now command eight-figure prices. They offer a way to access Basquiat’s hand and thinking at a scale many collectors find easier to live with than the monumental canvases. As recent auction results show, top works on paper can lead evening sales and function as collection centrepieces in their own right -

Prints and Portfolios

For many new collectors, this is the most realistic path into Basquiat. Here, education is critical. Understanding the distinction between lifetime and posthumous editions, signed versus plate-signed works, and the relative importance of specific portfolios (for example, the superhero, Daros or Hollywood Africans suites) can make the difference between acquiring a work that tracks the artist’s core market and one that lags behind it.

Across all tiers, there are a few constants sophisticated collectors watch closely:

-

Year and Period – Works from 1981–83, Basquiat’s most productive and critically favoured window, command a meaningful premium.

-

Iconography – Crowns, skulls, griots, boxing heroes, and dense textual fields are more sought-after than marginal motifs.

-

Provenance and Exhibitions – A clear ownership chain, inclusion in major shows, and references in catalogues raisonnés enhance liquidity and value.

-

Condition – Particularly in works on paper and prints, condition can create silent tiering; two ostensibly similar works may diverge significantly in price.

The Broader Context: A Cooler Market, But a Strong Narrative

The global art market has been through an adjustment. Reports across 2024 describe a double-digit decline in sales at major auction houses, with many younger or over-speculated artists seeing substantial price compression. Basquiat, often grouped with these “market stars,” has not been entirely immune to repricing – particularly for less exceptional material – but the core of his market remains fundamentally different.

Why? Because Basquiat now operates less as a fashion and more as a canonised figure: represented in major museum collections, embedded in academic and curatorial discourse, and increasingly understood as a central voice in late-20th-century art history. That structural depth gives his market resilience even when headline numbers soften.

Looking Ahead: What to Expect in 2026

Projecting any art market is speculative, but some trends for Basquiat into 2026 are reasonably clear:

-

Quality Polarisation Will Intensify

The gap between truly outstanding works and middling material is likely to widen further. Expect record-level bidding for rare, fresh-to-market masterpieces, while late or weaker works may continue to trade more cautiously. For collectors, this makes rigorous selectivity even more important. -

Continued Normalisation of Prints as “Serious” Assets

Given the long-term 10–15% CAGR in the print segment and the renewed demand seen in 2025, it is reasonable to expect further consolidation of prices for key portfolios in 2026, assuming broader market stability. Well-chosen prints may offer a more measured, less volatile way to participate in Basquiat’s market than chasing high-beta paintings. -

Institutional and Scholarly Focus

New books and exhibitions – such as recent research into the making of Basquiat’s market and legacy – continue to refine the narrative around him. As scholarship deepens, works that align clearly with the emerging “canon” (in terms of subject, period, and documentation) are likely to enjoy a premium. -

Selectivity from Buyers, Discipline from Sellers

In a market that is more data-rich and less speculative than a few years ago, both sides of the transaction are better informed. Collectors increasingly benchmark against auction histories, edition data and comparative pricing; sellers are adjusting estimates to match a more disciplined demand. For committed collectors, 2026 may offer a window in which pricing is rational, supply is still available, and competition is robust but not manic.

Basquiat’s market in 2025 is not about easy money or rapid flips. It is about aligning capital with an artist whose cultural, historical and aesthetic importance is now firmly entrenched. For collectors willing to do the work – to understand the tiers of quality, the nuances of editioning, and the realities of a post-boom market – 2026 is likely to be a year of considered opportunity rather than speculative frenzy, and Basquiat will remain one of the defining artists around whom to construct a serious contemporary collection.